The https://english.atlatszo.hu use cookies to track and profile customers such as action tags and pixel tracking on our website to assist our marketing. On our website we use technical, analytical, marketing and preference cookies. These are necessary for our site to work properly and to give us inforamation about how our site is used. See Cookies Policy

As EU imports drop, China is about to become the biggest importer of Russian energy

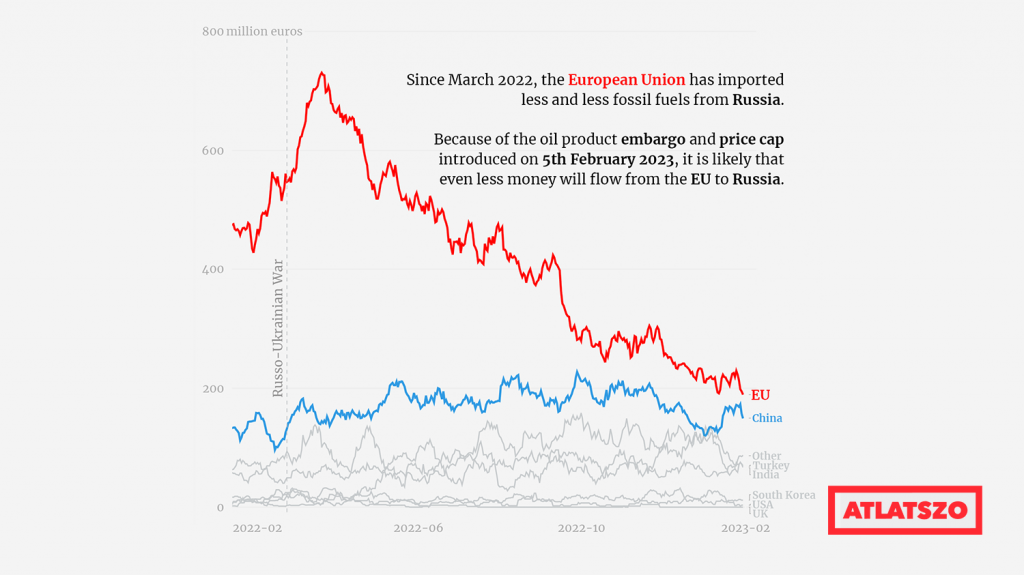

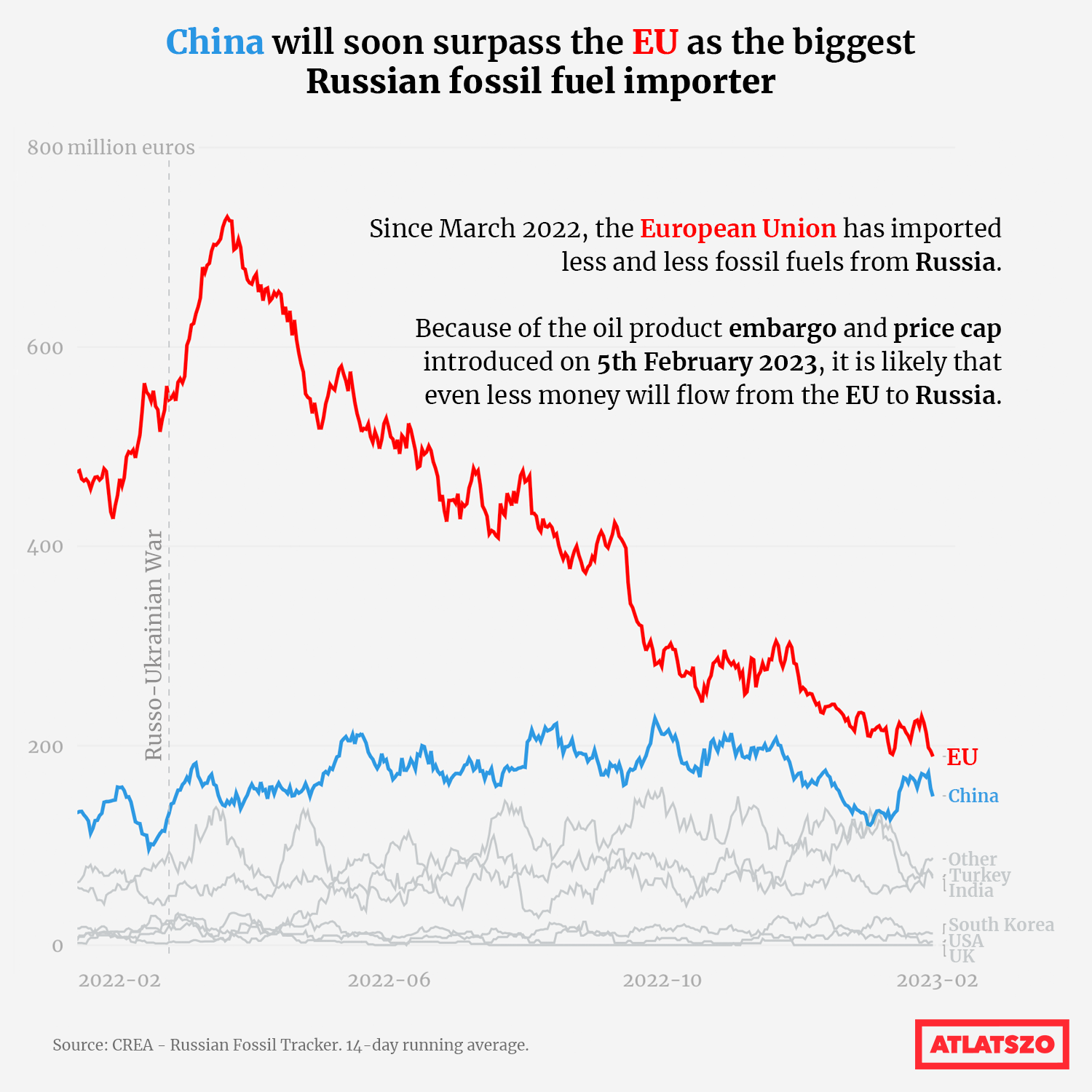

On 5th February 2023, new EU measures against Russia came into force. Russian oil products, including petrol and diesel refined from Russian crude oil, are banned from entering the EU by sea. At the end of January, the European Union still spends the most money on Russian energy of all importers. Because of the sanctions, however, China is slowly starting to replace the EU as the biggest spender on Russian energy.

The new embargo, which came into force at the beginning of February 2023, bans imports of Russian oil products into the European Union, including refined petrol, diesel, kerosene, heating and lubricating oil made from Russian crude oil. Within the EU, trade of products processed from Russian crude oil is also banned as part of the embargo. EU companies are not allowed to assist Russia’s trade with third countries, except in cases where transactions are at or below the price cap.

The price cap for products sold at a premium to crude oil is $100, while the cap for products sold at a lower price than crude oil is $45. The agreement includes a 55-day wind-down period for Russian petroleum products that were shipped before the 5th of February and will be unloaded at the final port of destination before the 1st of April.

The impact of EU sanctions on Russia visualised and explained in infographics – English

The Hungarian government launched a National Consultation survey on “failed sanctions against Russia” in mid-October, even though Hungary has voted in favour of all the sanctions packages. The deadline for completing the questionnaire was 15 December. In this article, we go through the survey questions and also look at the impact of EU sanctions on the Russian economy and trade.

During the negotiations, Hungary obtained an exemption for oil shipments through pipelines, which means that we will still be able to process and sell products of Russian origin domestically, but the new measure could make intra-EU trade more difficult.

Euronews reported on the oil ban, saying that the price cap is designed to keep oil flowing to countries such as China and India, so as to avoid global shortages and a surge in prices. But for Russia, the benefits will be much lower.

Less export revenue from the EU to Russia

Since the beginning of the war, Russia has earned a total of €239 billion from fossil fuel exports. Roughly half of this (€140 billion) has been financed by European Union countries, according to CREA data.

The Centre for Research on Energy and Clean Air’s (CREA) Russia Fossil Tracker project tracks how Russia’s energy exports have been affected since the start of the war in Ukraine. They do this by tracking the movement of ships and the flow of pipelines.

Their analysis shows that the European Union’s imports of Russian fossil fuels have been steadily declining since the end of March 2022. In monetary value, we paid half as much for energy to Russia in January 2023 as we did before the war. CREA’s analysis uses a 14-day moving average, which shows a longer-term trend rather than the most recent situation. In the past few weeks, there have been days when China outperformed the EU, but this was not persistent.

In terms of the moving average, the EU remains the largest importer of Russia, but is only slightly ahead of China. With the 5 February embargo and price cap on oil products, it is likely that even less money will flow from the EU to Russia from February onwards, and China could permanently take over the top spot. Besides the European Union and China, the largest importers are Turkey, India, South Korea, the United States and the United Kingdom.

Globally, Hungary ranks as the ninth largest importer since the start of the war, but sixth in terms of the EU. Up to now, we have imported a total of €8.2 billion worth of Russian gas and oil as of February 2022.

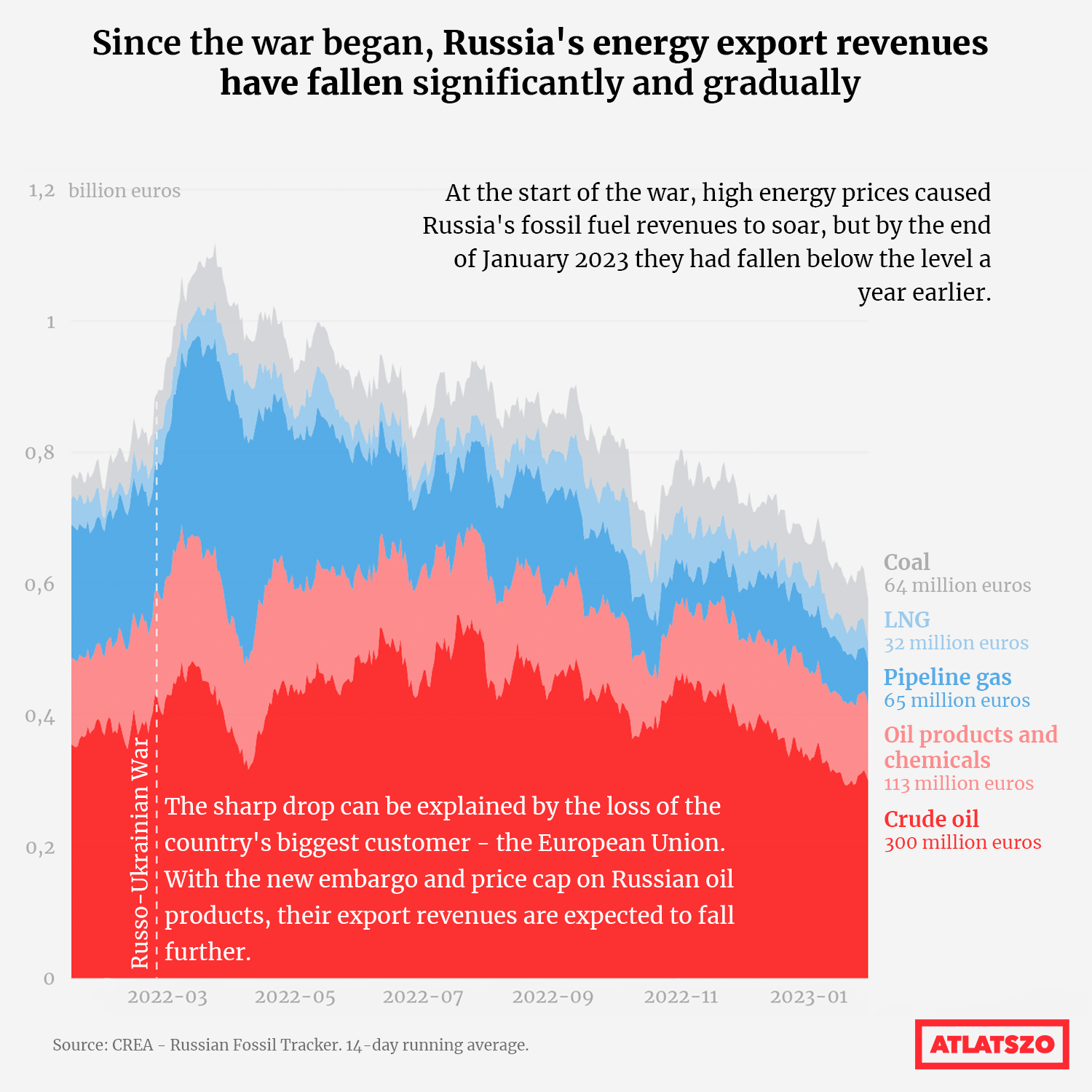

In terms of volumes exported, Russia supplies almost the same amount of fossil fuels – so it can maintain exports without the EU – but receives much less revenue. While high energy prices at the start of the war led to a sharp rise in revenues, by the end of January 2023, Russia’s income fell below the level it had been a year ago.

This means that the sharp decline is explained by the loss of the European Union, the largest former importer. Crude oil continued to account for the largest share of Russia’s export earnings, averaging €300 million a day at the end of January. A significant source of financing was also provided by exports of oil derivatives, which averaged €113 million a day last month. Given that there is an EU-embargo on Russia’s most important revenue-generating energy commodities, its export revenues could fall even further than where they currently are.

Written and translated by Luca Pete. The original, Hungarian version of this story can be found here.